Starter

Starter

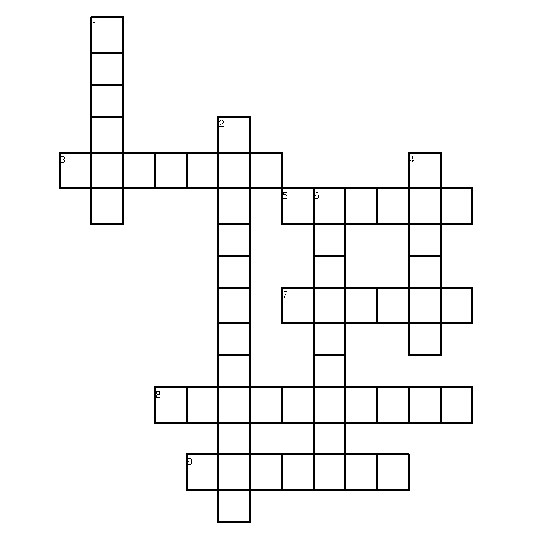

Complete this online booking systems crossword!

Clues

Across

3. The input for accepting terms and conditions

5. Where you enter your debit card details

7. Where you start your booking

8. Input for choosing when to go

9. An input with only 2 possible options

Down

1. All pages would have this button

2. Where you are given a booking reference

4. Where you choose from a list of options

6. Online bookings systems are ________ to implement

Introduction

Banking Applications

ICT has revolutionised the way that we do banking, allowing near instant global access to a wide variety of banking services. This lesson looks at the banking services that are now provided by ICT and the computer processing that takes place.

Source: Wikipedia

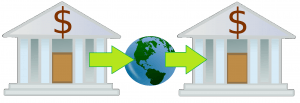

EFT

Electronic Funds Transfer

Electronic Funds Transfer (sometimes known as a wire transfer) is the electronic transfers of funds from one bank account to another, anywhere in the world.

Transfers can be near instant, or take a couple of days, depending on the nature of the transaction and the arrangements between the banks.

Wire transfer computer processing

The money sender gives their bank the receiver’s bank account details and requests an amount of money to be sent.

The bank checks that the destination bank is valid and deducts the funds from the sender’s account

Advantages

- Money can be sent globally  rapidly to help in emergency situations (airline failure, medical emergencies).

- Can be send anywhere on the globe.

- Safer than carrying cash around the world on a plane.

Disadvantages

- Often used in fraud and blackmail.

- Money can be hard to trace between countries, leading to money laundering and tax evasion.

ATMs

Automatic Teller Machines

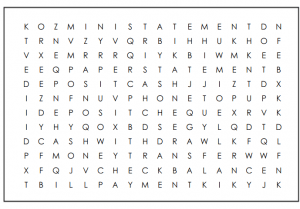

ATMs are useful for a number of different services. Can you find the 9 common services hidden in the word-search below?

ATM Computer Processing

- The user puts their card in the machine and enters their PIN.

- The computer checks the PIN entered against the PIN stored on the card.

- The user enters the amount of money they require

- The machine authorizes the transaction with the user’s bank. The user’s bank deducts the funds from the user’s bank account.

- The machine issues the cash. The user’s bank now owes the card machine bank money.

- The user’s bank wire transfers the owed amount to the card machine’s bank.

- The transaction is now complete.

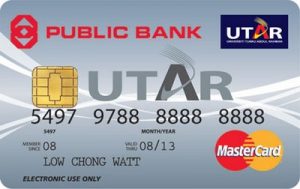

Credit / Debit Cards

Credit / Debit Card Processing

- Customer Puts their card into the machine and enters the pin

- The card machine checks the pin entered against the stored pin

- The card machine contacts the issuing bank via the internet / telephone and requests authorisation for the transaction.

- If the transaction is authorised, and authorisation code is issued.

- The issuing bank deduct the funds from the cardholder’s account and sends an electronic funds transfer to the card machine operator’s bank

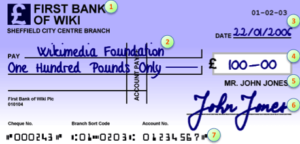

Cheques

Computer Processing of cheques

- The money sender takes a cheque from a cheque book and writes a cheque. The data written include:

- The cheque amount

- The recipient’s name

- The date(most cheques are valid for 6 months from the date of issue)

- The recipient takes the cheque to their bank.

- The bank then request and authorisation for the funds from the money sender’s account(this step is known as clearing)

- If there are sufficient funds in the sender’s account and the cheque is valid, the money’s senders bank clears the cheque and sends the funds to the recipient’s bank.

- Once the recipient’s bank receives the funds, it transfers the funds to the recipient’s bank account.

This whole process usually takes up to 5 working days.

Disadvantages of cheques

The is a long time delay between issuing a cheque and the money clearing. Most companies will not issue goods or services until the cheque has cleared, so it creates problems with time critical services such as flights.

Phone Banking

Phone Banking

Customers can use phone banking to perform similar functions are those which can be complete using face-to-face or online banking. These include:

- Querying transactions and account balances

- Sending funds

- arrange overdrafts

- Paying bills

- Requesting a written statement

Phone banking is very useful for those people who don’t have, or don’t trust online banking, as it allow them access to their bank account when banks are closed ( such as evenings, weekends and bank holidays)

Internet Banking

Internet Banking / Mobile Banking

Internet banking (via a web browser) and mobile banking(via an app), allow customers to perform a number of functions that used to be reserved for face-to-face banking.

Advantages

- 24 /7 Access

- Can access on the go using banking apps

Disadvantages

- Phishing is possible

- Large amounts of branch closures and unemployment

- Glitches and crashes can mean that some people can’t access their money